How can our financial advisor help you?

Income and Expense Planning

Effectively manage your income and expenses to achieve lasting financial stability.

Income and Expense Planning

Effectively manage your income and expenses to achieve lasting financial stability.

Investment Planning

Analyse and optimise your investments for better returns and long-term growth.

Investment Planning

Analyse and optimise your investments for better returns and long-term growth.

Insurance Planning

Stay prepared for unexpected life events with a reliable insurance plan.

Insurance Planning

Stay prepared for unexpected life events with a reliable insurance plan.

Income Tax Planning

Reduce your tax liabilities by strategically planning your taxes.

Income Tax Planning

Reduce your tax liabilities by strategically planning your taxes.

Loan & Debt Planning

Effectively manage and reduce your loans and debts for improved financial health.

Loan & Debt Planning

Effectively manage and reduce your loans and debts for improved financial health.

Will & Estate Planning

Secure your legacy and ensure your assets are distributed as per your wishes.

Will & Estate Planning

Secure your legacy and ensure your assets are distributed as per your wishes.

Get your 1 st financial plan for FREE

Also, save on commissions for your existing investments and insurance.

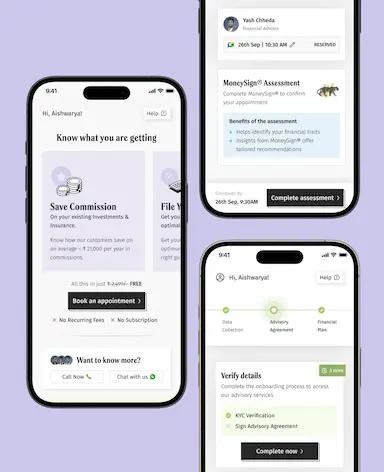

How it works

Book a meeting & take your MoneySign® assessment

Consult with a Qualified Financial Advisor

Get a financial plan along with execution support

Book a meeting & take your MoneySign® assessment

Consult with a Qualified Financial Advisor

Get a Financial Plan along with Execution support

Frequently Asked Questions

What is financial planning?

Financial planning is a process that helps you manage your finances better. It covers everything from planning your income and expenses to building a corpus for your retirement.

How is financial planning different from investment planning?

Investment planning is only a small part of financial planning. A solid financial plan includes insurance planning, investment planning, loan & debt planning, will & estate planning, retirement planning and tax planning. It helps you achieve more than just returns on investment — it gives you peace of mind.

What are the costs associated with Discovery Securities service?

Your first financial plan with Discovery Securities is absolutely FREE. This means you can get to know your financial personality, consult our financial advisor, ask questions, get advice, and receive a financial wellness plan—all at no cost. After the first consultation, you may choose to take quarterly reviews and pay per session basis.

Do I need to open a demat account to start with Discovery Securities?

No, you do not need to open a demat account to start with Discovery Securities. We do not sell any financial products, and there is no need for new investments to begin your financial planning with us.

I already have a CA, so why do I need Discovery Securities for my financial planning?

While a CA handles tax filing and accounting, we offer a complete range of services to help you manage your finances better. This includes insurance planning, retirement planning, tax planning, loan & debt planning assistance, and more.

What is MoneySign®?

MoneySign® is our patented technology designed to reveal your financial personality through a scientific assessment. It's free of cost—all you need to do is answer a set of questions. The assessment will uncover your financial strengths and weaknesses, helping you understand your financial behaviour better.

Who is a Qualified Financial Advisor?

A Qualified Financial Advisor at Discovery Securities is a professional with top certifications like CFP CM , CWM®, CFA, CA, NISM XA XB, QPFP, or SEBI RIA. They are experienced in all aspects of financial planning.

What would I be getting in the meeting?

You'll receive a thorough review of your finances, personalised advice, and an actionable plan. We'll discuss your current financial scenario, address your queries, and guide you towards financial well-being and peace of mind.

How can I trust Discovery Securities with my data, and what data security measures does Discovery Securities take?

We take your data security very seriously at Discovery Securities. We follow strict data protection regulations to ensure your personal and financial information is kept safe and confidential. We never misuse your data.